Exactly How Bid Bonds Protect Contractors and Ensure Task Stability

Important Actions to Obtain and Utilize Bid Bonds Effectively

Browsing the complexities of bid bonds can considerably impact your success in protecting agreements. To approach this efficiently, it's vital to comprehend the essential steps involved, from gathering necessary paperwork to choosing the best surety provider. The trip starts with arranging your economic statements and a comprehensive portfolio of previous tasks, which can demonstrate your integrity to potential guaranties. However, the real difficulty exists in the careful selection of a reputable company and the tactical usage of the bid bond to boost your competitive edge. What complies with is a more detailed consider these important stages.

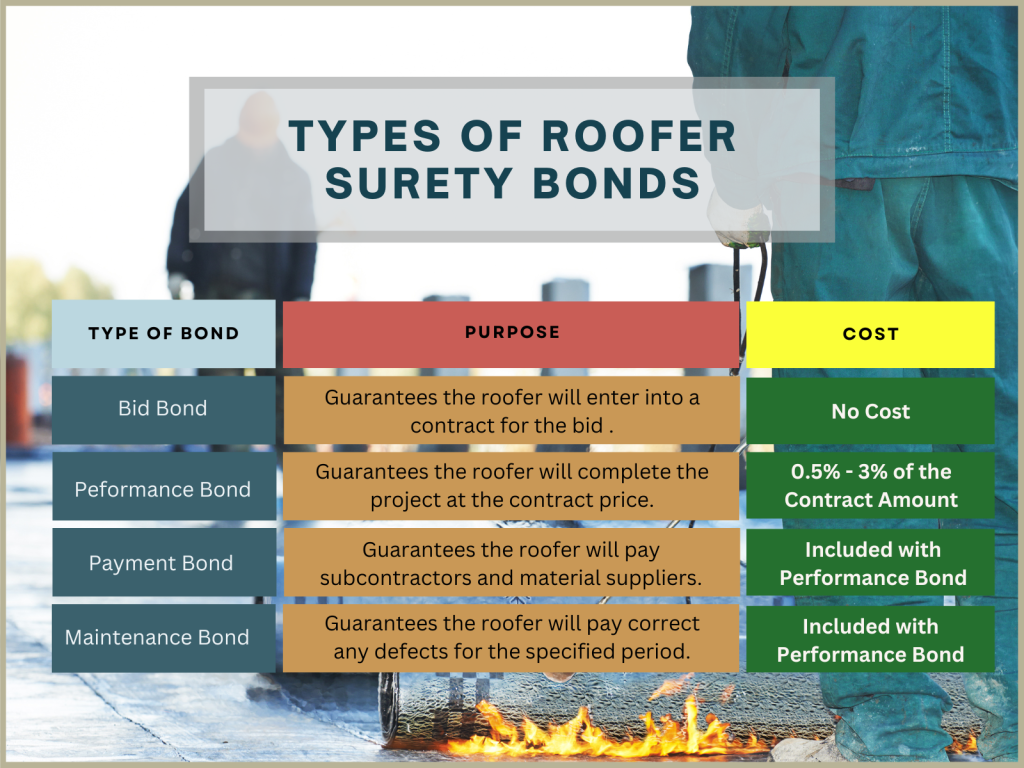

Understanding Bid Bonds

Bid bonds are an essential part in the building and contracting sector, offering as a monetary assurance that a prospective buyer intends to become part of the agreement at the bid cost if granted. Bid Bonds. These bonds reduce the danger for job owners, guaranteeing that the selected professional will certainly not just honor the quote however additionally safe and secure performance and payment bonds as needed

Fundamentally, a quote bond functions as a guard, protecting the job owner against the economic effects of a professional taking out a proposal or failing to commence the project after selection. Generally provided by a guaranty company, the bond assurances compensation to the owner, often 5-20% of the quote quantity, ought to the specialist default.

In this context, bid bonds promote an extra competitive and reliable bidding process atmosphere. They oblige professionals to present reasonable and significant proposals, knowing that a financial charge looms over any type of violation of commitment. Additionally, these bonds ensure that only financially steady and legitimate professionals get involved, as the rigorous credentials process by guaranty firms displays out less trusted prospective buyers. Quote bonds play a crucial role in maintaining the honesty and smooth operation of the building bidding process.

Planning For the Application

When preparing for the application of a proposal bond, meticulous organization and extensive paperwork are extremely important. An extensive testimonial of the project requirements and quote needs is necessary to make certain conformity with all stipulations.

Next, assemble a listing of past projects, specifically those comparable in scope and size, highlighting effective completions and any kind of distinctions or qualifications obtained. This strategy provides a holistic view of your firm's technique to project execution.

Ensure that your company licenses and registrations are current and readily offered. Having actually these documents organized not just expedites the application process yet additionally forecasts a specialist picture, instilling confidence in possible guaranty suppliers and project owners - Bid Bonds. By systematically preparing these components, you place your business positively for successful bid bond applications

Locating a Guaranty Provider

Additionally, consider the carrier's experience in your specific industry. A surety business aware of your field will much better comprehend the unique dangers and requirements related to your jobs. Request referrals and examine their history of cases and client complete satisfaction. It is likewise suggested to evaluate their financial ratings from companies like A.M. Ideal or Requirement & Poor's, ensuring they have the economic toughness to back their bonds.

Engage with several carriers to contrast solutions, prices, and terms. A competitive evaluation will aid you protect the ideal terms for your proposal bond. Inevitably, an extensive vetting process will certainly make certain a trustworthy partnership, cultivating confidence in your proposals and future jobs.

Sending the Application

Sending the application for a quote bond is an important step that requires careful attention to information. This procedure begins by collecting all relevant documents, consisting of monetary declarations, job requirements, and a comprehensive organization history. Making sure the accuracy and efficiency of these documents is vital, as any kind of discrepancies can lead to denials or hold-ups.

When submitting the application, it is suggested to ascertain all entries for precision. This consists of confirming numbers, guaranteeing proper trademarks, and confirming that all essential add-ons are included. Any kind of mistakes or noninclusions can undermine your application, causing unnecessary complications.

Leveraging Your Bid Bond

Leveraging your proposal bond properly can considerably boost your one-upmanship in securing contracts. A quote bond not just shows your financial stability but likewise comforts the project owner of your dedication to meeting the contract terms. By showcasing your proposal bond, you can underscore your firm's dependability and integrity, making your proposal my website attract attention among countless competitors.

To utilize official site your proposal bond to its fullest potential, guarantee it is provided as component of a comprehensive bid package. Highlight the toughness of your surety carrier, as this reflects your company's financial health and wellness and operational capability. In addition, emphasizing your track record of successfully completed projects can further impart self-confidence in the job owner.

Additionally, keeping close interaction with your surety service provider can promote much better conditions in future bonds, hence strengthening your affordable positioning. A proactive method to managing and renewing your bid bonds can also prevent lapses and make sure constant insurance coverage, which is critical for recurring task acquisition initiatives.

Verdict

Successfully getting and utilizing bid bonds necessitates comprehensive preparation and strategic execution. By comprehensively organizing vital documents, picking a respectable guaranty provider, and submitting a total application, firms can secure the essential proposal bonds to boost their competition. Leveraging these bonds in propositions emphasizes the company's dependability and the stamina of the guaranty, inevitably increasing the chance of safeguarding contracts. Continual interaction with the surety provider makes certain future chances for effective project proposals.

Identifying a credible guaranty company is a article source crucial step in protecting a bid bond. A bid bond not just shows your financial security yet also guarantees the job proprietor of your commitment to meeting the agreement terms. Bid Bonds. By showcasing your proposal bond, you can underline your firm's integrity and reputation, making your quote stand out amongst various competitors

To take advantage of your quote bond to its greatest capacity, ensure it is offered as part of a detailed proposal package. By comprehensively organizing crucial documents, picking a credible surety company, and submitting a total application, companies can protect the required quote bonds to improve their competition.